The Securities and Exchange Board of India (“SEBI”) has, on 15th January 2020, published a Consultation Paper on Review of Regulatory Framework for Investment Advisers (“IAs”) to seek comments from the public on the proposals that are intended to strengthen the regulatory framework for IAs as well as empower the IAs to effectively discharge their responsibilities towards the investors who are their clients.

Background:

SEBI had been receiving numerous investor complaints against IAs that they were charging exorbitant fees from clients with a false promises of handsome returns, incidents of mis-selling by IAs without adhering to the risk profile of the client non-disclosure of complete service fees/charges and instances of extracting money in the name of various charges. Such conduct of these entities is against the interest of investors. Considering such complaints, SEBI had issued orders against various entities who were violating the provisions of IA regulations and SEBI ( Prohibition of Fraudulent and Unfair Trade Practices relating to the Securities Market) Regulations, 2003.

To further strengthen and make the IA Regulations robust and align the regulatory framework with the developments in the securities markets, SEBI had issued three consultation papers dated 7th October, 2016, 22nd June 2017 and 2nd January 2018 seeking public comments on various proposals relating to segregation of advisory and distribution activities, usage of misleading nomenclatures by distributors etc.

A Working Group was set up in order to address the diverse views received during the aforesaid consultation process. The Working Group submitted its report to SEBI in December 2019.

The public comments are sought on the following proposals:

- Clear segregation between the two services provided to the clients i.e. investment advice and distribution of the investment products.

- The IAs ability to help the clients in implementation of the advice.

- The IA providing documents to the client detailing the terms and conditions of the investment advisory services offered to the client and shall ensure that neither any investment advice is rendered nor any fee is charged until consent is received from the client on the terms and conditions.

- Charging of fess by investment adviser in certain modes to a particular client.

- The minimum qualifications of individuals registered as an investment adviser under these regulations and partners and representatives of registered investment adviser offering investment advice.

- Modification of the requirements of the net worth required to be maintained by IAs

- The records of interactions with the client including prospective clients shall be maintained by IAs.

- The completion of compliance audit within three months from end of each financial year and post completion of said audit must report the adverse findings along with action taken thereof to SEBI within a period of one month from the date of the audit report i.e. not later than July 31st of each year for the previous financial year.

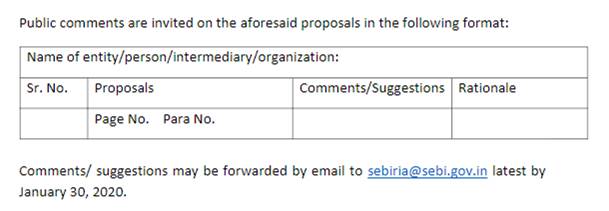

NOTE: To forward any comment / suggestion, please send it in the manner given below:

Source: Securities and Exchange Board of India